Latest articles on Life Insurance, Non-life Insurance, Mutual Funds, Bonds, Small Saving Schemes and Personal Finance to help you make well-informed money decisions.

Nearly 78% of the Indian retirees say they prepared adequately for their sunset years, according to a worldwide survey, Life after Work?, conducted by HSBC.

Here are some other revealing insights.

Transition to retirement

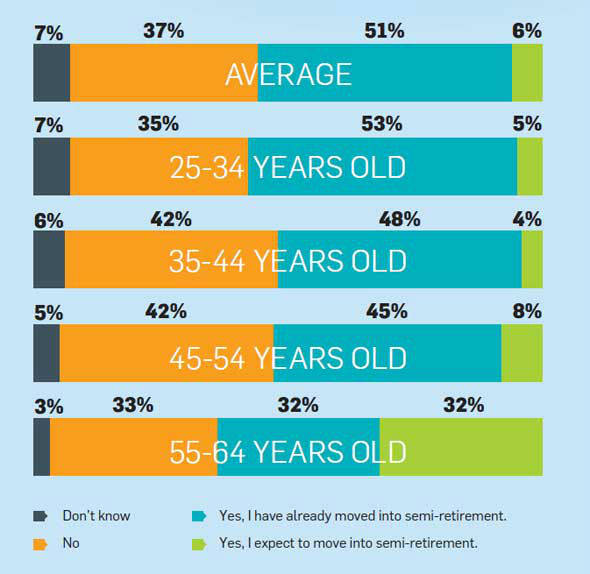

Do you expect to move into semiretirement before you retire fully?

Over half of the younger workers (25-34 years old) expect to reduce their working hours, but continue with some form of paid employment as they approach retirement.

|

Why do you expect to move into semiretirement?

While 44% of the respondents want to keep active, 43% like working and want to continue, and 39% feel it will ease the transition into retirement. However, financial worries are also a motivator.

|

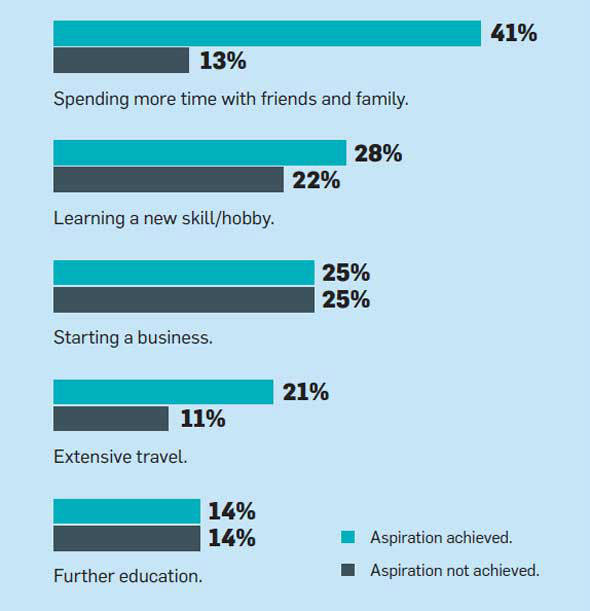

Aspirations vs reality

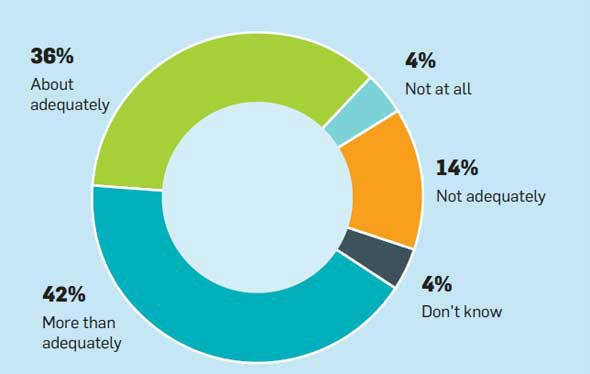

Did you prepare adequately for a comfortable retirement?

Two out of 10 retirees didn’t prepare well enough or at all. Of these, less than 24% realised their efforts were insufficient before retiring, and 18% don’t think they will bridge the shortfall.

|

|

|

ARN119467 & EUIN E-183966

ARN26176 & EUIN E-044509

ARN294073 & EUIN E-553599

Copyright © 2025 Design and developed by Fintso. All Rights Reserved