Latest articles on Life Insurance, Non-life Insurance, Mutual Funds, Bonds, Small Saving Schemes and Personal Finance to help you make well-informed money decisions.

Two thirds of the 10 crore two-wheelers on Indian roads are not insured. This despite the fact that driving a vehicle without thirdparty liability insurance is illegal. What’s more, a comprehensive cover for a 150cc bike with a declared value of Rs 30,000 costs just Rs 1,000-1,200.

A two-wheeler rolls out of showrooms with cover thanks to a mandatory clause and offers from auto dealers and brokers. But by the second year, most fall out of the insurance net. To combat non-renewals, the Insurance Regulatory and Development Authority of India ( IRDA) had, last year, allowed long-term two-wheeler insurance policies with a tenure of up to three years.

Now, India’s largest general insurer New India Assurance has become the first to launch products with two to three year tenures. More insurers are expected to follow suit. Buying a longer tenure policy is not mandatory, but an option. One benefit is that you need not worry about renewing your policy annually.

A break in renewal can prolong a policy purchase process in future. Once the policy lapses, most insurers insist on inspecting the vehicle before renewing it or issuing a fresh policy. Moreover, insurers are bound to offer upfront discounts on the own damage component premium.

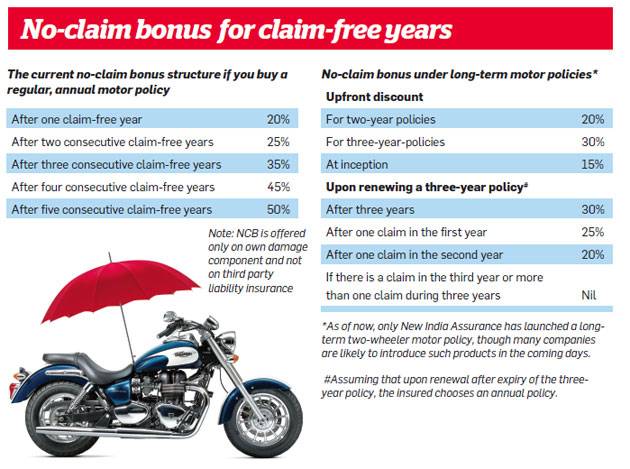

"The insured will get a 30% discount on the three-year cover. The insured will also be entitled to no-claim bonuses post the tenure," says G. Srinivasan, Chairman, New India Assurance. The company offers discounts of 20% and 30% on two-year and three-year policies respectively (see chart). You could also save on premiums if you buy a long-term third party liability cover as IRDAI hikes third party cover tariffs by 20% every year.

The flipside? "If market premiums go down in future, the insured will be locked into a higher rate. He will also not be able to improve the quality of cover during the tenure of the longterm insurance," says Arvind Laddha, CEO, Vantage Insurance Brokers.

ARN119467 & EUIN E-183966

ARN26176 & EUIN E-044509

ARN294073 & EUIN E-553599

Copyright © 2025 Design and developed by Fintso. All Rights Reserved