Latest articles on Life Insurance, Non-life Insurance, Mutual Funds, Bonds, Small Saving Schemes and Personal Finance to help you make well-informed money decisions.

The sharp rally in mid and small-cap shares in the last three years has given fund managers the opportunity to pick winners that helped boost performance of their schemes. Mid-cap and small-cap stocks have outperformed large-cap stocks by a huge margin over the last three years. As per data from Value Research, the mid-cap fund category’s three-year annualised return is 34.51% against the large-cap category’s 18.16%.

The BSE Midcap index is up 133% over the last 3 years, surging from 5,601 to 13,050. As economic growth was slow due to a series of global and local factors, smart fund managers took over to identifying and picking up mid-cap stocks with a bottom-up approach.

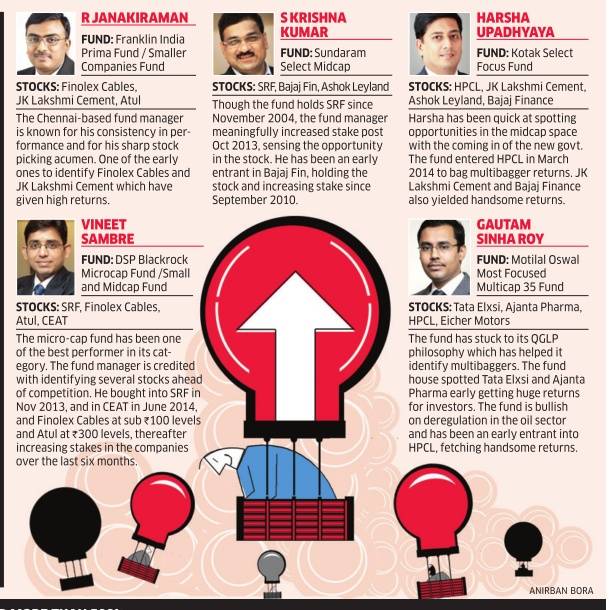

"Fund managers have done a great job in identifying mid-cap companies," says Kaustubh Belapurkar, director (fund research), Morningstar, India. We take a look at some fund managers who were quick to spot stocks which gave these high returns:

ARN119467 & EUIN E-183966

ARN26176 & EUIN E-044509

ARN294073 & EUIN E-553599

Copyright © 2025 Design and developed by Fintso. All Rights Reserved